Co-writer Liam Ostrowski

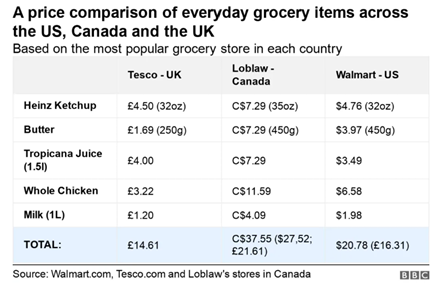

If headlines and political proclamations are any indication, Canadians are upset about current grocery prices.[1] One recent article by the BBC[2] highlighted examples of high prices in Canada versus similar items in the United Kingdom and United States from specific grocers.

While the focus of the BBC article was on anger toward Canadian grocer Loblaws and concerns of lack of competition, the article’s content begs a wider look at grocery prices in recent years.

We start with looking at prices of specific groceries. The basket of items chosen by the BBC article was compared to other regions in the following table:

At first glance, these are horrifying price differences for the poor Canadian shopper. However, the prices are only normalized for currency in the totals and not adjusted for differences in mass and volume. [Suspicious data points in BBC’s Canada column – $7.29 for all three of ketchup, butter, and juice – turned out to be misleading, as a visit by BIG Media to a Loblaws “No Frills” store in Vancouver revealed pricing of $5.99 for Heinz Ketchup (35 oz/1 litre), $4.79 for butter (454 g), and $4.49 (“Save $1.30”) for Tropicana juice.]

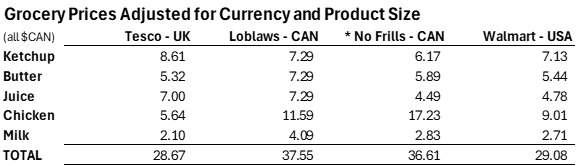

After adjusting for currency, mass, and volume to compare apples to apples (or ketchup to ketchup), we have the following comparison (including bonus pricing from Loblaws “No Frills” in Calgary):

Overall, Team Canada is still paying more than the UK and U.S. in total, but with a wide variance by item, including ketchup being less expensive in Canada than the UK (shoutout to Leamington, Ontario, for the tomatoes). Our added discount store pricing from Canada is more in line with UK and the U.S. for most products. Chicken is much higher in Canada, but this comparison is flawed without unit pricing by mass. Logically, we would expect regional sources of products to have production advantages and lower prices for domestic shoppers (e.g., orange juice cheaper where oranges grow, ketchup cheaper where tomatoes grow). Every country has its own domestic subsides and supply management systems that will influence consumer prices.

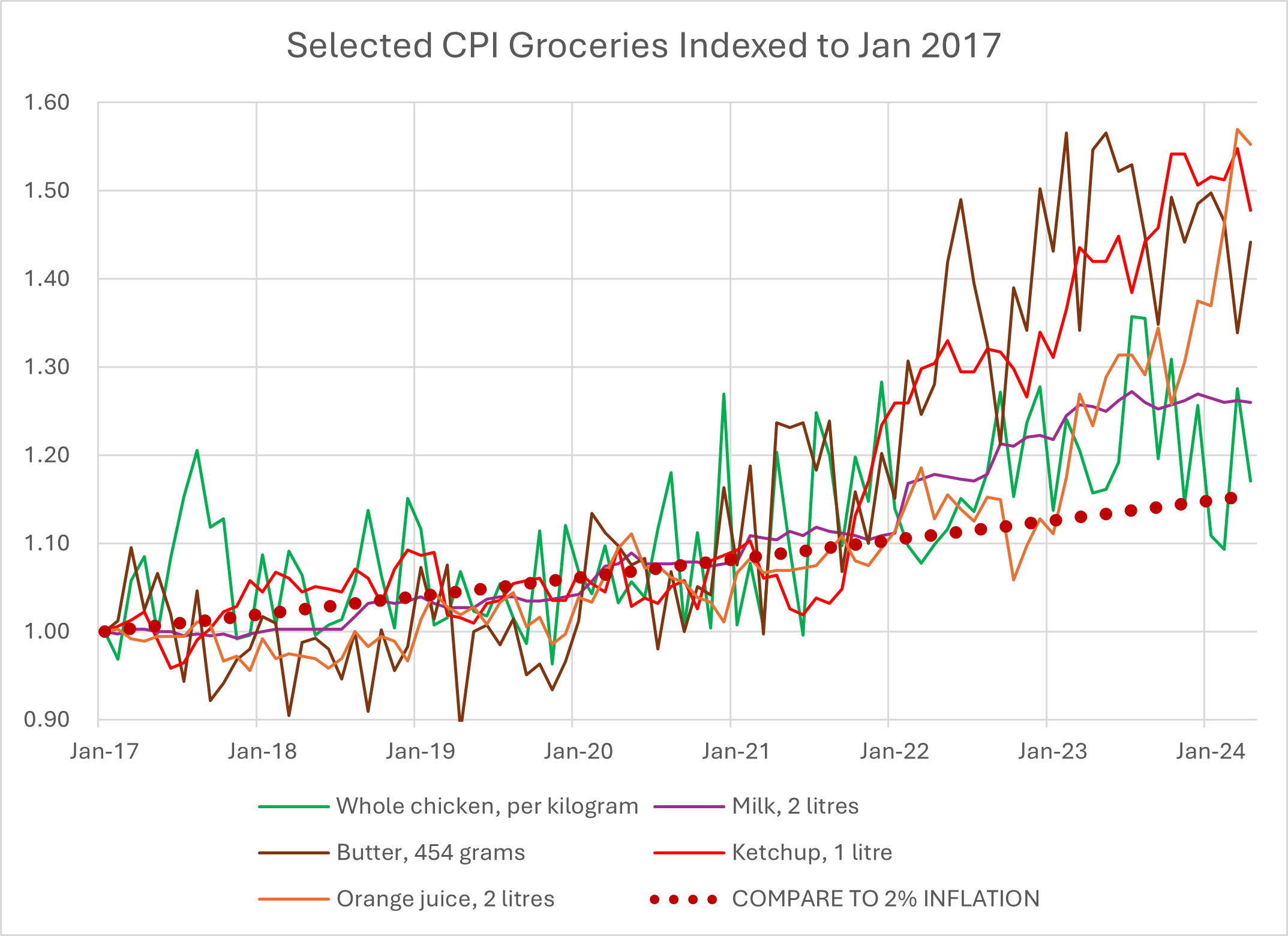

The grocery comparison is a snapshot in time, so looking at grocery prices over the last few years can help determine if the comparison is an anomaly or a consistent trend. To use consistent data for our basket of goods over time, national consumer price index data is used (CPI definition and data here[3]). As shown in the following chart, the general trend of individual prices is disrupted in the period of late 2021 into 2022, resulting in higher prices or greater price volatility. This coincides with the start of the COVID “reopening” and impacts from the Russo-Ukrainian war.

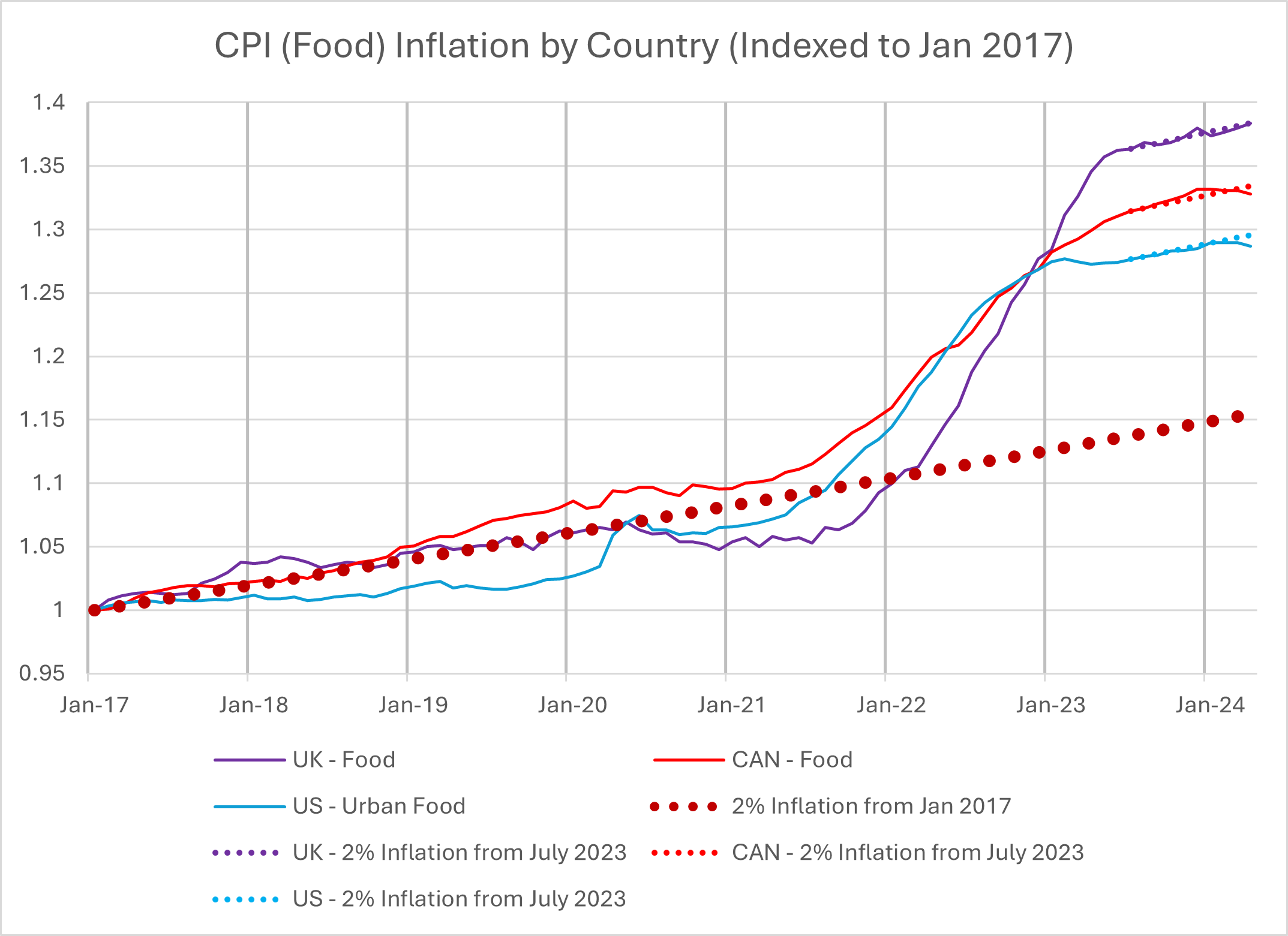

The grocery comparison only looked at a handful of items, so the next step is to examine the wider CPI trends for Canada. The UK and U.S. use similar methods for their CPI, so a reasonable comparison can be made.

CPI data clearly shows that the trend of accelerated prices, especially for food, is an international phenomenon, a trend occurring between mid-2021 and mid-2023. By mid-2023, food prices appear to have stabilized closer to a historical 2% inflation benchmark.

The CPI defines prices but not the causes of changes in pricing. There are several factors involved, two of which are discussed below:

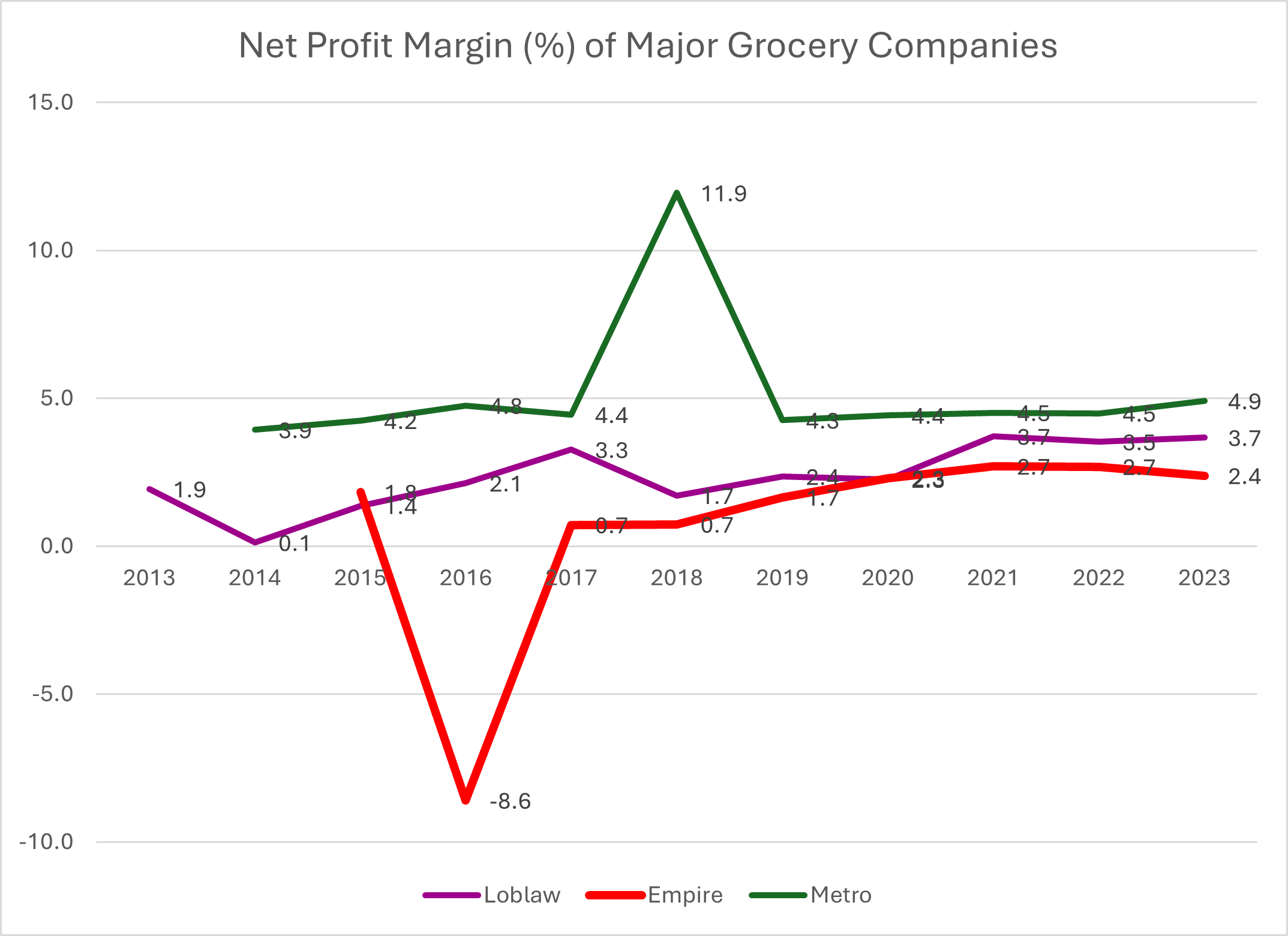

- Grocer profits: Canadian public, news media, and government have been quick to place blame on the largest grocery stores: Metro, Empire and Loblaws. Loblaws has received fierce criticism after registering record profits through the COVID-19 pandemic. These earnings represent an increased share of profits from revenue (grocery and other products and services), with the company averaging a net profit margin of 3.1% for the years 2019-2023, a near doubling compared to the previous five-year period margin of 1.7%. Empire and Metro have shown similar performance.[4]

- Production costs: Canada’s farm input costs (Statistics Canada) show a 35% increase in the cost to produce food, with fuel, fertilizer, and feed rising by 90%, 48%, and 45%, respectively, Q3 2021 through Q3 2023.[5]

Propositions that greedy grocery stores have created price increases by raising profit margins does not seem to match with the real picture, at least in the case of Canada. Analysis of net profits of Canada’s largest grocery stores indicates that any increase in margins has been overall modest. Loblaws appears to have reaped more profits than peer competitors. Meanwhile, increased production costs from suppliers appear to be validated by government data on domestic farming costs.

Grocery prices are affected by several domestic and international factors; no single factor can be blamed for price increases. Despite the desire to find a single solution (or villain), the likely answer for reducing prices is multi-faceted. Grocery prices appear to have stabilized to pre-COVID inflation levels at higher baselines, reflecting new realities of cost inputs.

References

[1] Canadians feel grocery inflation getting worse, 18%are boycotting Loblaw: poll , Nearly two-thirds of Canadians feel grocery inflation is getting worse, poll, Federal NDP want a price cap on grocery store staples, Liberals say it won’t work

[2] Why Canadians are angry with their biggest supermarket (table revisions used UKP = 1.75 CAD and USD = 1.37 CAD as well as normalizing pricing for Canadian mass/volume)

[3] Consumer Price Index Portal

[4] Company financial statements

[5] Farm input price index, quarterly

Edward – You make no mention of Canadian supply management programs, which include the poultry and dairy items in your basket of food products. This could/will be a large factor in leading to these specific items being priced higher in Canada.