There is a tremendous power unleashed if all involved in the business, share in the wealth creation of the business. It is an old idea that has not been taken up at scale.

If it had been in Canada, for example, my home country would not be in the ever-declining innovation, productivity, and wealth distribution situation in which we find ourselves. This is not a hypothesis, or untested theory; this is a fact, based on my lived experience, having been involved in a successful employee-owned organization for over 30 years and backed up by significant documented success in the United States, the United Kingdom, and in numerous academic studies.

Capitalism is an economic and political system in which a country’s trade and industry are controlled by private owners for profit. Those private owners, driven by profit and more, can be the employees of the company creating the product, solution, or service.

Employee-owned companies could be the backbone of a growth-oriented economy. The benefits are great and include better work cultures, improved strategic execution, increased productivity, improved innovation, superior and faster growth, improved resilience through tough times, supportive community outcomes, and a lasting legacy of multi-generational wealth creation and distribution through consistent and better business outcomes and profit generation.

Profits are distributed to the direct benefit of the employees who are owners in their company. Financial success for the employee-owner leads to family financial security, and higher local community investment. Of course, governments also benefit through increased income taxes to support a country’s multitude of social supports and programs.

It sounds like a can’t-miss concept, doesn’t it? So, why is it so uncommon?

Well, employee ownership takes long-term thinking; what some might call patient capital. It requires an entrepreneurial mindset across the organization. It also takes a level and focus on employee/owner engagement and succession planning that many founders and companies are not up for. Perhaps most importantly, it requires a belief that all workers should share in the fruits of their labour through more money in their pockets, rather than having the rewards funneled to a small group of leaders, or external investors and investment houses. Employees are rewarded with returns common in private equity (PE), not the PE firm principals and investors.

Small and medium businesses are the economic backbone of our country. In Canada, 99% of the country’s 1.23 million businesses are small (1 to 99 paid employees) or medium (100 to 499 paid employees) in size. They generate over 50% of Canada’s gross domestic product (GDP) and collectively employ over 11.3 million Canadians.

Although it is difficult to estimate accurately how many of these 1.2 million businesses are set to be sold or handed off to others, some estimates suggest about 70% of company “founders” are set to retire over the coming 5-10 years. It is surely at least in the tens of thousands of companies, creating an ideal opportunity to pursue employee ownership and employee-owned companies as a new pillar of our economy.

Culturally, nothing can beat it. Stakeholders are aligned through ownership. There are no faceless, nameless outside shareholders to please, no special interest groups to which you are beholden. Employees are aligned with management, as they are all stakeholders in driving the outcome of the organization and sharing in the benefits.

Employee-owner culture creates a loyalty not possible in other corporate structures. Voluntary employee turnover is consistently far less then industry averages. My personal experience has it less than 3%, or about one-third of industry averages, performing at those levels consistently for over six decades and counting. People stay where they are valued, where they feel they are contributing, and where they have connection to their workmates.

It also creates a culture of accountability and engagement unlike any other structure. Each employee wants their fellow owners to succeed both for the benefit of their workmates and for themselves. A “you win/I win”, way of thinking. So, whether it is for altruistic reasons or for self, owners support owners’ success. The most common feedback I hear from our new employees is that “everyone is so helpful.”

Austrian-American educator/author Peter Drucker was famously quoted as saying “culture eats strategy for breakfast.” I agree that a company’s culture is key to any sustained success. Short-term wins are certainly obtainable without employee alignment and through other management structures including command-and-control operations, but I believe multi-generational success is very unlikely with such approaches.

Work attitudes and engagement levels change over time. Adaptability to our ever-changing world around us will best come from companies in which stakeholders are working on the problems of the day, together. Collaboration and connection, therefore, trump internal competition and individualism. Inter-dependence not independence. Best overall work outcomes are seen as the goal, not political outcomes. External market competition gets the full focus of the employee’s energy; it is not wasted internally.

With culture alignment comes the opportunity for strategic alignment. Employee-owners are respected as key contributors to the execution of the strategy and therefore are “read in” on where the company is headed, how we plan to get there, their role in that strategy, and, most importantly, why we have chosen certain approaches and strategic elements. Employee-owners have “skin in the game”; they are invested in the company’s success.

I have found that employee-owners are much more likely to want to understand the why. They are also more willing to engage in the plan and give feedback or suggestions on where to improve and how to achieve better results. They are committed stakeholders in delivering on the strategy and executing the plan.

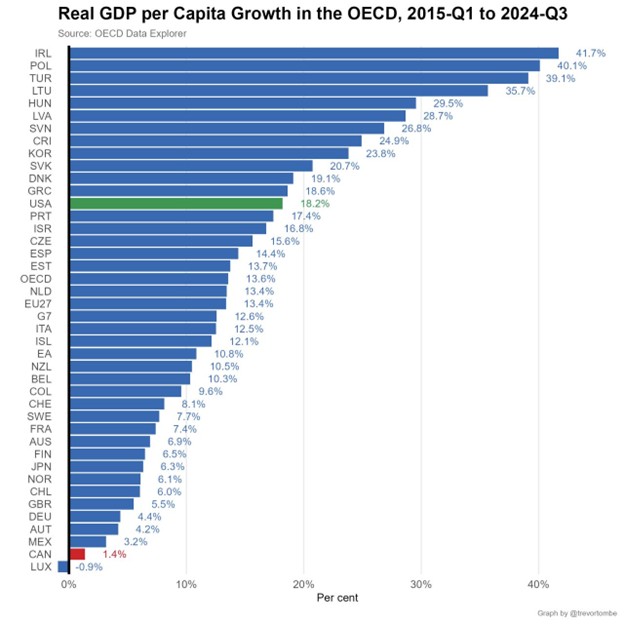

It is this level of engagement that creates the opportunity for increased innovation and productivity, and Canada certainly needs that. For the period Q1 2016 to Q3 2024, Canada ranks 39th out of 40 Organization for Economic Co-operation and Development (OECD) countries and economic regions, with a real GDP per capita growth of just 1.4%.

The top 10 countries delivered over 20% growth, with Ireland #1 at 41.7% and Poland second at 40.1%. The U.S. comes in at 13th with 18.2% growth. Better than Canada are many countries without the tremendous advantages we have with our modern society including rule of law, plentiful resources, multi-lateral trade agreements, and high post-secondary education levels. Most notable, however, is that the OECD ranked Canada dead last in their futures forecast for GDP per capita, based on our current trajectory of falling economic success and lack of any coherent national growth ambition or plan. Also, per the S&P Global Market Intelligence assessment of Canada’s industrial production performance, Canada is in a multi-year decline.

Being more productive does not mean working longer hours. Canadians are working on average 1,706 hours per year (Average Working Time By Country). That puts Canada ahead of places such as the UK, Germany, and Australia, but behind the USA at 1,790 and Poland at 1,963 hours. It is not about working harder. Productivity comes more from adequate training, developing your employees to meet the challenges of the task, creativity from the workforce in driving improvements in workflows, execution excellence, and tools used for getting the work done.

With low turnover of employee-owned organizations comes the opportunity to continuously grow a worker knowledge base that is difficult for competitors to match, as the employee-owners are often the ones who are making the improvement suggestions. In my personal experience, owners are more open to being trained and continuing to develop, for their benefit, job satisfaction, and to the overall benefit of the organization and shareholders.

This attitude extends to the use of tools, automation, and robotics as ways to improve outputs. Supporting task efficiency, execution efficiency with automation is embraced. It is not just management’s role; it is everyone’s responsibility for continuous improvement. It is in all employee-owners’ best interest to drive out inefficiencies with the knowledge that growing productivity grows the business, the size of the pie for all, and at a faster rate. The employee-owners are often finding ways to increase throughput, outcomes, and outputs.

An innovation mindset also drives ever-increasing productivity. Continually raising the bar on how you execute, and on what you spend your investment dollars and time. Owners are more willing to not only see the connection, they actively participate to drive the continuous improvement necessary to thrive in today’s very competitive world. Innovation means change, and as difficult and uncomfortable as change may be, owners, when they clearly understand the why, the upstream and downstream benefits to them, and the organization of the change, are more likely to adapt well to the change. Not just to be ok with it; in many cases they will lead the charge. Innovation happens across the enterprise. It occurs within individuals improving their work or function, across teams and throughout the organization, as more innovation and success lead to more desire to innovate.

With a winning culture, aligned strategy, an innovative mindset, and improved productivity, employee-owner organizations can be unstoppable. They can become powerful growth platforms, as owners aligned on the why drive exceptional outcomes. That growth comes from organic markets and taking market share, and from driving new markets or adjacent opportunities for growth into the next big thing.

While an estimated 1 in 12 startups succeed, and only 1 in 18 new products ever get to market, employee-owner organizations create the environment in which those odds can be beaten. My personal experience is that better than 3 in 4 new initiatives or new endeavours launched within our enterprise and green-lighted to pursue within our growth-planning process, achieve success. That is a remarkable track record of success that could not be possible without the support of our employee-owners.

Our owners’ drive for increased profit-sharing also drives a level of external competitiveness that is exceptional and supportive of above-market growth. Owners have a level of commitment to the cause that is difficult to beat, as in our structure, it is their money, their investment, that are supporting and driving our growth. Not doing it for someone else, some unknown investor, but for them, their co-workers, and their teams.

Employee-owned companies are more resilient through the ups and downs of market swings and changing times. As the employees are invested in their company, there is a level of commitment that is special. So, during more difficult times, the owners dig deeper, apply themselves and generally work at problems with more diligence than non-employee-owned organizations. It is their business, so there is a level of responsibility and accountability for meeting the challenges of the day. As owners, they also directly experience the potential for reduced financial outcomes and in extreme cases the possibility of financial loss. This is a significant motivator with which all entrepreneurs and business owners are familiar.

Over the last two decades, notable severe challenges were experienced with the global financial crises, the oil-price collapse and, most recently, the pandemic. All three challenges provided an excellent example of the power of employee-owners and working through very difficult and unpredictable times. In the most recent example, not only did we manage successfully through the immediate pandemic impacts of a much-reduced spending environment and lower constrained market, we came out of the pandemic with growth momentum as we kept our workforce in place. All owners taking less, not laying off our employees, and fellow owners looking out for each other. So, as with other previous market downturns, we were able to grow above market, as we were not wasting any of the recovery on on-boarding new employees or executing poorly due to lack of experience.

Resilience through tough times and the accompanying job security is a key benefit that should not be underestimated. Equally important is financial security. Many employee-owned companies distribute their profits directly to their employees. As a result, strong company financial outcomes lead to improved personal earning outcomes. Many workers are seeing their wages fail to keep up with inflation, especially over the last four years, even though company financial performances have been very good across multiple sectors.

That disconnect is illustrated by the “Common Man CPI vs Wages” index. This index is a comparison of the cost of life’s basic essentials – energy, food, shelter, clothing, utilities, and insurance – to wages over a multi-year period. There should not be a disconnect among employee-owned companies, as wage growth and employee-owner share returns match the rate of company financial performance. When the company’s earnings go up, the owners participate directly and proportionately.

On average, per the USA Employee Stock Ownership Program (ESOP), employees are 2x better off financially than non-owners. My experience is consistent with that. It follows that owners can then build net worth over time, making them and their families more resilient to ups and downs, and leading to multi-generational wealth creation.

The corresponding increased financial outcomes for successful organizations go well beyond the individual. In a Harvard Businesses Review on Employee Ownership, in addition to some of the above benefits, they discussed the wealth gap between the top wage earners and the rest. Households in the bottom 50% own on average just $825 of private stock and $522 in public company stock. Meanwhile, the top 1% of wealth holders own 56% of businesses.

Broadening wealth distribution beyond the top wage earners and into more business ownership for others is an outcome of employee ownership, not the goal, and will create better societies. Better performance leads to better profits, which leads to better overall incomes, which creates financial security. This enables improved outcomes for families and communities in so many aspects of life, from access to comfortable homes, high-quality food, improved health, safer and more resilient communities, and generally improved lifestyles. Employee-owned companies are also more like to invest locally, creating jobs and associated economic benefits in the communities in which we live and work.

Many models of employee ownership exist, and there are myriad ways to create structured programs. In the U.S., and more recently in the UK, ESOP have been formalized through government legislation. Although Canada is late to the party, and its programmatic approach is just getting launched and improvements could certainly be made, it is a step in the right direction. It is now creating the conditions and the right conversation around employee ownership in Canada, and this work needs to continue. It needs to happen locally, within our business communities and politically, within our elected governments, enabling this transformational new economic pillar and approach to building a successful and growth-orientated economy.

Founders and business owners, whether starting out with a new business endeavour today, or if you have been leading a successful business for decades, now is the time to leave a lasting legacy. A culture of empowered and energized employees, delivering superior business outcomes, growing wealth for all, and creating multi-generational value. Nothing in life is permanent, and our individual efforts may one day be forgotten. However, I believe Einstein was on the mark when he said, “Try not to become a man of success but rather try to become a man of value.”