Since the introduction of Barack Obama’s Pivot to Asia policy framework in 2011, U.S. foreign policy has focused on strengthening diplomatic, economic, and military ties with countries in the Asia-Pacific in response to a bipartisan recognition in Washington that the People’s Republic of China (PRC) is preparing to displace the United States from its dominance over the Indo-Pacific region (The U.S. Pivot to Asia and American Grand Strategy).

The historical basis of this geopolitical shift in U.S. foreign policy has its basis in the 1999 Cox Report, also known as Report of the House Select Committee on U.S. National Security and Military/Commercial Concerns with the People’s Republic of China

Arguably, the inspiration behind the Cox Report was the 1997 Chinese Communist Party’s (CCP) formally codified 16-Character Policy (Figure 1) that defines the CCP’s purposeful blurring of the lines between state and commercial entities, and military and commercial interests (The Cox Report: Chapter 1

PRC Acquisition of U.S. Technology).

The sixteen characters literally mean:

- Combine the military and civil

- Combine peace and war

- Give priority to military products

- Let the civil support the military

Figure 1 – Deng Xiaoping’s 1997 “16-Character Policy”, which governs the PRC’s economic, technological and geopolitical strategy (https://thoriumenergyalliance.com/wp-content/uploads/2023/05/ChinaSubsidiesStructuralAdvantages-ReleasedMay2.23.pdf)

This policy holds that military development is the object of general economic modernization, and that the CCP’s main aim for the civilian economy is to support the building of modern military weapons and to support the aims of the People’s Liberation Army (PLA)(PRC Acquisition of U.S. Technology).

The CCP’s weaponization of Chinese corporate affairs is made possible in large part because, as of 2023, there are 80 billionaires filling senior cabinet roles within the CCP, the People’s National Congress (PNC), and the State Council (Senior Executive Branch).

In fact, the estimated net worth of these billionaire PNC delegates as of March 2023 was over $720 billion CDN (China’s Communist Party billionaires who own more than £400bn of wealth).

The State Council – which controls the PRC’s military-industrial organizations through the State Commission of Science, Technology and Industry for National Defense (COSTIND) – has a decisive role in policy because of its function as interpreter, implementer, and overseer of policy goals.

Created in 1982, COSTIND eliminates conflicts between the military sector’s R&D (research and development) and production functions, by combining them under one organization. Since 1982, COSTIND’s role broadened to include the integration of civilian research, development, and production efforts in the military.

COSTIND presides over a vast, interlocking network of institutions dedicated to the specification, appraisal, and application of advanced technologies to the PRC’s military aims. The largest of these state-owned institutions are styled as corporations, despite being directly in service of the CCP, the PLA, and the State Council. They are:

- China Aerospace Corporation (CASC)

- China National Nuclear Corporation (CNNC)

- China North Industries Group (NORINCO)

- Aviation Industries Corporation of China (AVIC)

- China State Shipbuilding Corporation (CSSC)

Under President Xi Jinping, there has been an accelerating centralization of control with the State Council, accomplished through reversing some market-oriented reforms of his predecessors, increasing use of ideological indoctrination and organizational discipline within the party, tightened control over society, including increased censorship, surveillance, and repression of dissent.

This includes crackdowns on human rights lawyers, activists, and ethnic minorities (Xi Jinping’s Political Agenda and Leadership: What do we know from his decade in power).

In fact, the number of private enterprises officially having embedded CCP political officers to ensure corporate governance was aligned with CCP policies, increased from 27% in 2002 to 48% in 2018 (CCP branches out into private businesses).

Centralization of corporate ownership and political control allowed China’s CleanTech manufacturing sector to divert profits from other market segments as part of an effort to rapidly build out manufacturing over-capacity.

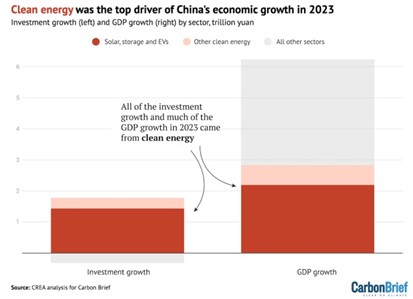

Figure 2 shows the PRC’s investment capital by three market segments, as a percent of GDP in 2023, decreased in-flows for non-CleanTech sectors, while capital in-flows for the CleanTech sector were almost 2% of GDP.

This positive investment bias is how the CleanTech sector constituted almost 50% of total GDP growth in China in 2023 and achieved an annual revenue base of $1.6 trillion USD (Analysis: Clean energy was top driver of China’s economic growth in 2023).

Likewise, this investment bias is one of numerous mechanisms through which the CCP’s State Council is able to flood the global CleanTech market, thereby bankrupting competitors and increasing global market capitalization.

This practice is why many western nations, including Canada, are imposing tariffs on CleanTech imports (From solar to EVs: How China is overproducing green tech).

Figure 2 – Chinese economic growth bolstered by the West’s obsession over “net zero” emissions.

The response of the PRC to western tariffs on their CleanTech products include banning of the export of process technologies specific to the extraction, separation, and refining of rare earth elements and other critical minerals, as well as banning outright such critical minerals as gallium, germanium, and some forms of graphite, on which they have a near global monopoly (China’s rare earths dominance in focus after it limits germanium and gallium exports).

Figure 3 is introduced at this point to highlight the critical elements associated with CleanTech products such as solar PV, wind power, and electric vehicles.

Without going into a deep dive on the alphabet soup of elements used in these products, it is sufficient to state that the PRC maintains a virtual monopoly on the entire supply chain, or has become the largest swing producer associated with these high importance elements (The raw-materials challenge: How the metals and mining sector will be at the core of enabling the energy transition).

Figure 3 – Qualitative importance of critical elements in common “net-zero” technologies.

The PRC has become equivalent to OPEC when it comes to its control over the global critical minerals and metals industries. Whether it is upstream exploration and mining, or downstream refining and advance manufacturing, the PRC is undoubtedly supreme (China’s growing dominance in critical minerals: Implications for global markets and geopolitics).

The near monopoly that the PRC has attained in the rare earth elements (REE) space is a prime example.

REEs are a group of 17 elements found in the periodic table, including well-known names such as neodymium, dysprosium, and lanthanum. Despite the group’s name, these metals are not rare in terms of abundance but are challenging and costly to extract and refine due to their dispersion in ores and high environmental impacts.

These elements possess unique magnetic, optical, and electronic properties that make them indispensable in a plethora of modern technologies.

For instance:

- Neodymium and dysprosiumare critical for making high-performance magnets used in electric vehicles (EVs), wind turbines, and advanced electronics

- Lanthanumplays a vital role in hybrid car batteries and camera lenses

- Yttrium, europium, and terbiumare essential in creating vibrant colours for LED screens

Moreover, the defence industry relies heavily on REEs for advanced applications, such as missile-guidance systems, advanced radar systems, jet engines, and satellite communications. This makes them a strategic resource with massive implications for national security.

The implications of the PRC having 100% control over high-performance EV magnets and nearly 98% control over gallium and gallium-nitride semiconductors (https://pubs.usgs.gov/periodicals/mcs2024/mcs2024-gallium.pdf) used in the radar systems of fifth-generation stealth fighters such as the U.S.’s F-35 Lightning and the F-22 Raptor, or in ship-borne anti-ballistic-missile-capable western naval vessels (10 Most Advanced Radars in the World 2024).

Since 2020, the U.S. Department of Defence has been funding critical mineral supply chain development on both sides of the Canada/U.S. border in an effort to take back sovereignty from the PRC.

However, considering that historical average mine-development times in North America vary from 18 (New Mine Average Lead Time Grows to 18 Years) to 29 years (US, Canada Among the Slowest in Mine Development Timelines, New Report Shows), it remains to be seen if even a wartime-like effort can address the national security issues at stake over the PRC’s supremacy in critical mineral supply chains.

Meanwhile, the PLA has been building out its blue-water-capable armada of guided-missile cruisers, destroyers, and aircraft carriers, of near-equivalent fire power as their American competitors, and at a pace only matched by the United States during WWII (Shipyard Image Exposes China’s Massive Naval Build-up).

By 2030, the PLA will match the U.S. Navy in both the number and tonnage of guided destroyers and cruisers.

Furthermore, the PLA has demonstrated a breakneck aerospace development pace of only 12 years to evolve from Gen 5 to Gen 6 fight aircraft (China’s groundbreaking 6th gen stealth fighter takes flight: How it could be a ‘super weapon’ that could alter global power dynamics), whereas the Americans have yet to achieve a Gen 6 flight testing phase status since the maiden flights of its Gen 5 F-22 Raptor air superiority stealth fighter in 1997.

In retrospect, former U.S. President Bill Clinton’s advocacy for the PRC to be admitted into the World Trade Organization (WTO) in 2001 was under the premise that this would lead to the long-term liberalization of the CCP (Remarks by the President in Address on China and the National Interest) and its economy.

History is showing this theory to be extremely naive.

While Clinton may have forgotten that the U.S. Democratic Party had financed, provided military aid, and intelligence support to the Chinese National Army in their civil war with Mao Zedong’s Chinese Red Army (U.S. Involvement in the Chinese Civil War), you can be sure that the PRC did not when it disingenuously signed onto the WTO’s admission conditions in 2001.

In closing, the answer to the riddle of whether the PRC’s dominance in critical minerals and CleanTech is a Trojan horse will ultimately be determined by whether its geopolitical rivals are able to wage a sustained war of attrition if a great power conflict arises this decade within the Indo-Pacific theatre.

The last I checked, it takes dispatchable, affordable energy, critical minerals, and, most importantly, the heavy industrial capacity to create modern weapons of war.

(Dr. Joseph Fournier – BIG Media Ltd., 2024)