The energy transition of the 21st century – the transformation of energy sources from primarily fossil fuels to a more diverse and resilient set of energy generators – is profoundly changing humanity’s demands on the earth’s resources.

Many of today’s key resources will continue to be important in the coming decades – e.g., iron ore, sand, and gravel, lime (for cement), coal, oil, natural gas, wood and other forest products are a few. But there are a number of critical minerals that are gaining attention as technologies evolve. We are already mining or otherwise extracting all of these today, but new applications, many linked to more diverse energy generation, are profoundly upsetting traditional supply-demand relationships. Some examples:

- Lithium – lithium-ion batteries are key components of energy storage in an increasingly electrified world. Electric vehicle (EV) batteries and short-term electricity storage to support electrical grids drive skyrocketing demand.

- Copper – copper has been a critical metal in our electrified societies for more than a century, but demand is growing rapidly as more things are electrified. An electric vehicle requires about three times as much copper as a typical internal combustion engine (ICE) vehicle.

- Helium – helium cannot be substituted in rapidly growing applications such as medical MRI machines and high-tech semiconductor and fibre-optic manufacturing, while geopolitical factors threaten some of the major sources.

- Rare earth elements – several elements that are important components of renewable energy tech such as wind turbines are rapidly achieving critical status. Current production and processing is focused in China.

- Cobalt – one of a number of metals important in battery technologies. Supply comes primarily from the Democratic Republic of the Congo, which has major human rights issues.

- Uranium – as nuclear energy grows rapidly in many nations, uranium demand is leaping ahead.

The International Energy Agency recognized the importance of critical minerals in energy transition in a key 2021 report (The Role of Critical Minerals in Clean Energy Transitions).

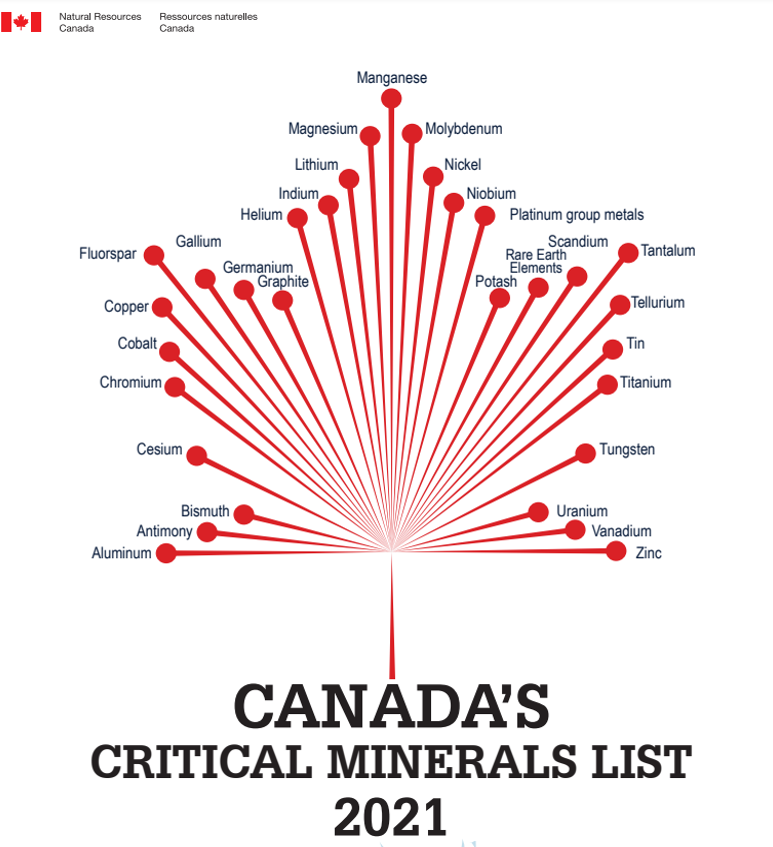

The United States Geological Survey (USGS) in 2022 released a list of 50 critical minerals “critical to the U.S. economy and national security” (U.S. Geological Survey Releases 2022 List of Critical Minerals), Canada has designated 31 elements as critical minerals (Figure 1), and other countries have similar lists. Some of the differences are not very significant – the USGS has broken out the rare earth elements, whereas Canada groups them into one category. On the other hand, the USGS removed helium and potash from their 2022 list, which is difficult to understand given the importance of these in high-tech and agriculture, respectively. One might speculate that current lists are driven by technologies directly related to low-emissions energy production and storage.

Figure 1. Canada’s Critical Minerals List, Critical minerals: an opportunity for Canada

Many national governments have issued critical mineral strategies:

- The United Kingdom did so “to bolster our energy security and domestic industrial resilience – in light of Russia’s illegal invasion of Ukraine – and as we move away from volatile, expensive fossil fuels.” (UK Critical Minerals Strategy)

- “Securing a Made in America Supply Chain for Critical Minerals” was issued by the Biden Administration in February 2022, recognizing that the United States is increasingly dependent on foreign sources for many processed versions of critical minerals (FACT SHEET: Securing a Made in America Supply Chain for Critical Minerals. The U.S. government has followed up by funding a number of initiatives to develop critical minerals mining and processing domestically.

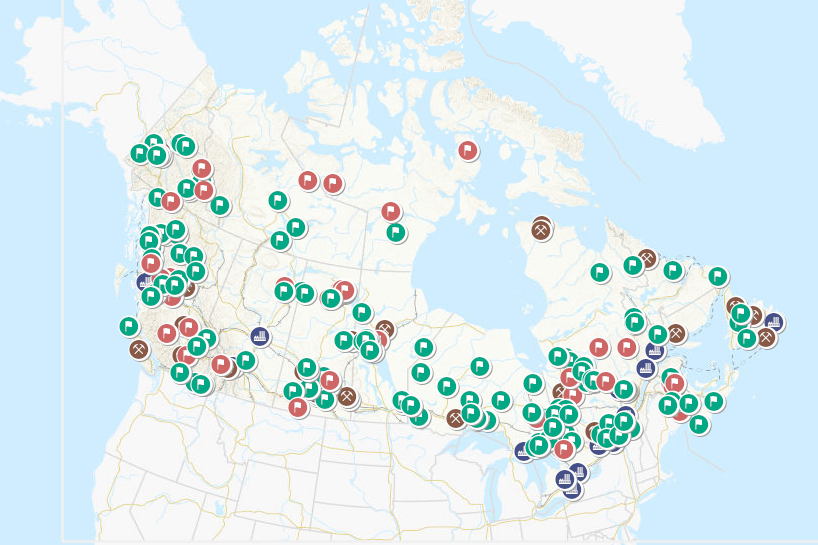

- The Canadian government recently announced a critical minerals strategy (Introducing Canada’s Critical Minerals Strategy), and maintains a Critical Minerals Centre of Excellence (Critical Minerals Centre of Excellence), where one can find an interactive map of critical mineral mines, processing facilities, and new projects (Figure 2).

Figure 2. Critical Minerals Map of Canada. This view shows mines, processing facilities, and new projects in an advanced stage of development. Lands and Minerals Sector – Critical Minerals

Policy experts are reinforcing the need for wealthy nations to move aggressively on critical minerals development in order to reduce geopolitical risks associated with sourcing key industrial materials from unfriendly or potentially unfriendly sources. See, for example, “The Coming Energy Transition: Industry’s Opportunities are not just in Canada” from Bazel and Mintz at the University of Calgary School of Public Policy (The School of Public Policy).

This all sounds great – governments, academia, and industry are all on board to promote critical minerals development in advanced nations. The U.S. and Canada can lean on traditional strengths as mining powerhouses, and many of the nascent players in international helium, lithium, and other critical mineral ventures are based in the U.S. and Canada. Resource entrepreneurs in both countries have in fact been pursuing critical minerals opportunities for several years now, seeing the emerging needs long before the current public focus.

But not all is rosy. Strategic disconnects like those that have hindered oil and gas development globally over the past decade threaten to disrupt orderly evolution of critical minerals markets as well. Another recent IEA report – Renewables 2022 (IEA Renewables 2022) – forecasts rapidly accelerating growth of renewable energy technologies, particularly wind and solar, in the immediate future. While critical minerals supply chains are mentioned in passing, the report does not run any sensitivities to test alternative growth models should critical mineral supplies not be available in ever-increasing quantities at ever-decreasing prices.

Yet the same explosive demand growth that drives new critical minerals ventures is already creating serious shortages and rapidly rising prices. Helium explorers are routinely running economics on prices of US$450 per thousand cubic feet – more than double the figure used just a few years ago. Lithium is attracting up to 10 times the price it did a couple of years age, and most other critical mineral prices are jumping. Meanwhile, substantial new supplies of most critical minerals – enough to change market dynamics – are years away, and in some cases cannot possibly meet forecast demand.

Even where global resources are adequate, geopolitical risks threaten efficient development. It took decades for non-OPEC oil and gas supply growth to limit the influence of OPEC on markets, and it will take comparable lengths of time to address similar problems with the supply of cobalt, rare earths, lithium, helium, and many other critical minerals.

As a result, big market distortions are clearly ahead. Emissions-driven policies set unrealistic goals for energy production that rely on explosive growth of renewable energy to have any chance of success. Statements like this one from Canada’s Minister of Natural Resources – “Canada’s Critical Minerals Strategy will enable the country to seize the generational economic opportunity presented by critical minerals, creating sustainable, well-paying jobs while growing our economy” – can be found in many policy press releases. But in a world where things actually happen, policy statements and sunny outlooks are not enough. Financial, regulatory, technological, and engineering supply-chain factors guarantee that new copper mines, commercial lithium extraction from saline brines, and other substantial supply initiatives are years away.

So, while fossil fuel supply growth (or even maintenance) is actively discouraged by American, Canadian, and European government policies, critical mineral supply realities will constrain renewable energy (and other technological) growth. New policy and ongoing research are responding to this immense strategic disconnect, but there is a bumpy ride ahead for energy supplies and prices. Let’s hope many nations succeed in expediting new domestic critical minerals supply growth in order to smooth out the road.

(Brad Hayes – BIG Media Ltd., 2022)