In the past month, I have attended two scientific conferences, each addressing a key component of humanity’s transition to more complex and diverse energy systems.

The North American Helium Conference, hosted by the Rocky Mountain Association of Geologists in Denver, brought together helium explorers from Canada and the United States to talk about finding and developing new sources of helium in secure domestic markets. The Atlantic Canada Carbon Neutrality Forum in Halifax explored how to bring carbon capture, utilization and storage (CCUS) to Eastern Canada in order to reduce net carbon-dioxide emissions from large stationary sources such as coal- and gas-fired power generation, biomass production, and heavy industry.

Helium is an essential substance supporting many high-tech applications, including medical imaging, rocketry, and manufacture of electronic components that support alternative energy generation and management. Markets are growing steadily while traditional supplies are at risk from depletion of U.S. sources and increased dominance by riskier trading partners such as Russia, Qatar, and Algeria.

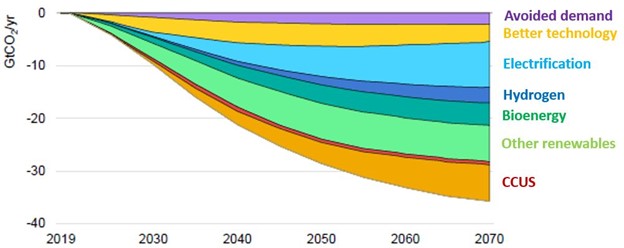

CCUS is recognized by knowledgeable analysts, including the International Energy Agency (IEA) and Intergovernmental Panel on Climate Change (IPCC), as an essential mechanism to reduce net greenhouse gas emissions from hard-to-abate sources CCUS in Clean Energy Transitions, IPCC Report Reaffirms Carbon Capture and Storage as a Critical Technology for Mitigating Climate Change (Figure 1).

Figure 1 – projected carbon-dioxide emissions reduction by measure, 2019-2070. CCUS will be one of the major measures. After IEA CCUS in Clean Energy Transitions Report

Figure 1 – projected carbon-dioxide emissions reduction by measure, 2019-2070. CCUS will be one of the major measures. After IEA CCUS in Clean Energy Transitions Report

Industry is developing technologies and methods to generate electricity, manufacture products such as cement and steel, and to refine and process fuels while creating far fewer emissions, but few are ready for application at commercial and economic scales. While development progresses, CCUS can fill the gap by capturing and storing emissions from existing high-emissions processes.

A key lesson I took from both conferences is that development and application of new processes – or even widespread application of known processes in different places and at different scales – is neither simple nor quick.

For example, helium has been produced commercially since the 1920s, extracted primarily as a trace component from natural gas streams in certain geologically favourable areas such as the western United States and Saskatchewan. Until recently, we relied primarily on chance discoveries of anomalously high helium concentrations during oil and gas exploration. As markets grew and traditional sources depleted, however, we have become more dependent on large liquefied natural gas (LNG) facilities in Qatar, Algeria, and Russia that extract helium economically at very low concentrations from the huge gas volumes they process every day.

Responding to higher demand and prices, entrepreneurs in the traditional oil-producing basins of Canada and the United States began to build new helium supply chains where none existed before. Dozens of junior exploration companies are exploring for helium, much as junior oil companies were leaders in exploring for oil and gas decades ago. Governments are encouraging and providing incentives for helium exploration in order to secure domestic helium reserves, reducing geopolitical supply risks. But even though the helium revival is 10 years old, significant new supplies are only beginning to come on stream.

Why the delay? Let’s look at some of the topics discussed at the North American Helium Conference:

- Rocks generating helium deep underground (source rocks) are different from oil and gas source rocks, so explorers must re-calibrate their exploration models and search different areas and formations from what they did for oil and gas.

- Existing regulatory systems governing production rights, royalties, and related issues for oil and gas must be modified to address helium. In places where various explorers are looking for different commodities – helium, oil and gas, hot (geothermal) fluids, lithium dissolved in saline brines, or capacity for water, waste, and CO2 storage – regulators have to make new rules and resolve evolving conflicts.

- There is little existing helium infrastructure. Every new helium discovery requires construction of dedicated processing facilities. These are expensive (usually $15-20 million dollars), and must be customized for each specific gas composition. Many customers want helium delivered in liquid form, which requires further processing at dedicated central facilities.

- Investors are not confident in their knowledge of helium exploration and markets, so are cautious about investing in new prospects and infrastructure.

- Some investors want to invest only in “green” helium – that is, helium that occurs with other inert gases such as nitrogen and carbon dioxide, not with oil or natural gas. Explorers working in areas in which helium is found with oil and gas can in many cases offer better economic returns, but may face more difficulty in attracting investors.

What about carbon capture and storage? As for helium production, we are dealing with a known technology, but we are applying it in many more areas and under new conditions. The oil and gas industry has been sequestering (storing) carbon dioxide in oil reservoirs for decades, using it to increase the amount of oil produced – hence the term enhanced oil recovery (EOR). The first project to re-inject carbon dioxide into the subsurface simply to store it was built at Sleipner in the Norwegian North Sea in 1996.

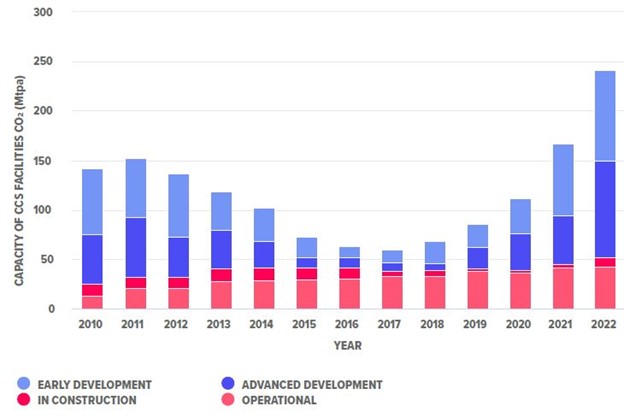

Pilot sequestration projects were built after Sleipner, and, by 2011, operational and planned carbon-storage projects reached total capacity of about 150 megatonnes/year (Figure 2).

Figure 2 – storage capacity of operational and planned carbon-sequestration facilities worldwide, 2010-2022. From Global CCS Institute 2022 Status Report

However, many of the projects under development were financed by oil and gas companies and were put on the back burner when world oil prices took a major tumble. More recently, CCUS planning and construction has accelerated rapidly, spurred by the realization that emissions cannot be eliminated at source rapidly, and by generous incentives in many countries.

But, as we saw for helium, even though technologies, skill sets, and data generated by the oil and gas industry can support CCUS, there are many barriers to rapid deployment of new CCS infrastructure. Delegates at the Atlantic Canada Carbon Neutrality Forum learned:

- Reservoir rocks suitable for carbon storage are not common.

- Even where suitable rocks exist, we do not know enough about them to plan and execute carbon storage unless previous oil and gas drilling has created datasets to characterize the reservoirs.

- Emitters in locations where CO2 cannot be sequestered nearby are faced with substantial transportation costs. For example, heavy industry in southern Ontario may need to consider shipping emissions by pipeline, rail, or tanker to Western Canada or to Eastern Canada offshore because local reservoirs may be inadequate.

- Most places, even those with an active oil and gas industry, do not have a regulatory framework adequate to guide safe sequestration and to address the attendant risks. Stakeholders including the general public and indigenous communities insist upon and deserve careful consideration of their safety and concerns.

- Investors hesitate to put money into sequestration projects because the potential for economic return on their investment is unclear. Big money must be spent, but revenue streams are not guaranteed; there is no product to be sold, and financial structures are generally not in place to define what storage operators will be paid per tonne of CO2 stored.

So we see that for both helium production and carbon sequestration – activities that will be central components of our evolving energy economy – there are significant barriers to rapid and large-scale implementation. No matter how badly we want them and need them, we need a lot of time to build them. We cannot quickly and easily solve the many attendant issues; solutions must be created carefully based on excellent scientific and engineering analysis, smart policy advances, and dedicated stakeholder education and support that can be built only with expertise, hard work, and time.

We can apply these conclusions to every component of evolving global energy systems. Improved solar panels, bigger wind turbines, better battery chemistries, small modular nuclear reactors, advanced electrical grids, and more efficient geothermal systems all offer the potential for more energy production with fewer environmental impacts. However, all must overcome significant financial, engineering, regulatory and other hurdles that can delay or even prevent achieving their potential in the real world.

So the concept that governments or low-emissions advocates can set emission-reduction targets to occur in certain timeframes based on interpretations of climate models is simply nonsensical. No matter how strongly one may feel that we “must” emit x% fewer greenhouse gases by 20xx (insert your favourite target numbers here), failure is inevitable without realistic pathways to implementation. The current state of the helium and CCUS industries, which we understand very well compared to most emerging technologies, shows us what an enormous amount of work is in front of us.

(Brad Hayes – BIG Media Ltd., 2023)