With files from Brad Hayes

An oft-cited criticism of wind and solar is that they are expensive and uneconomic in comparison to the incumbent generation sources (coal, gas, hydro, and nuclear) that make up the bulk of global electricity generation. Higher electricity prices are, of course, undesirable to most consumers, but they would also hinder widespread adoption of wind and solar. To date, this issue has been addressed with subsidies and incentives put in place by governments and policymakers.

However, reducing carbon dioxide concentrations in the atmosphere requires global action. The bulk of future energy demand growth is projected to come from the developing world, where access to affordable energy is a key driver of development and poverty reduction. It is, therefore, unlikely that renewable energy sources would be prioritized if they came at a significant cost premium. This viewpoint has fed into the view of renewables as a luxury good for wealthy countries. For renewable technologies to truly alter the course of global GHG emissions, they need to be cost competitive.

One method of making comparisons across power-generation technologies is expressing costs in terms of “levelized cost of energy” (LCOE). LCOE represents the minimum price that an energy-generation investment would require over the course of its useful life in order to break even. Similar to the lifecycle environmental impacts discussed in the previous article on environmental impacts, this metric takes a full-life view of an energy investment to reach across differences such as fuel source, operating costs structure, and lifespan to produce an estimate of the cost to generate a unit of energy over the lifecycle of the property.

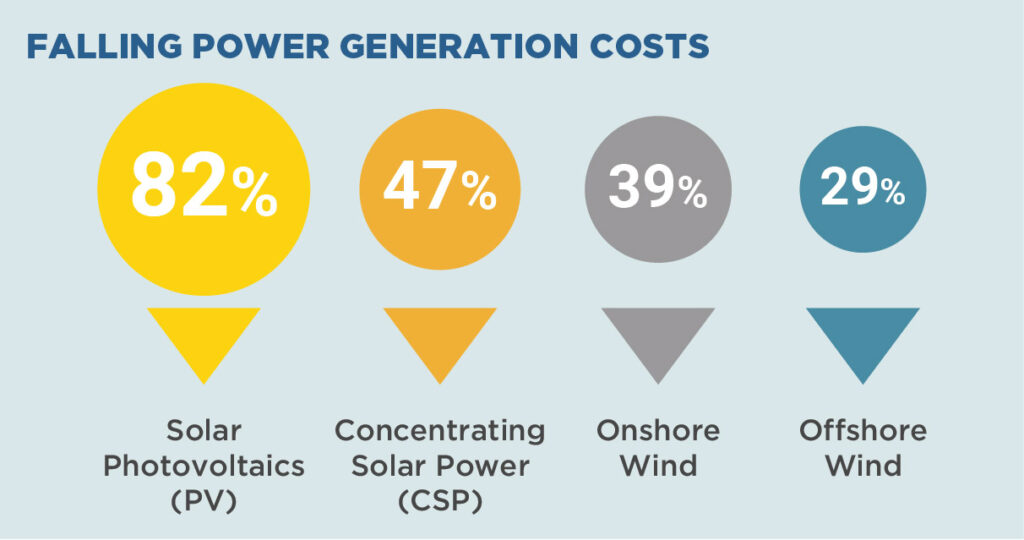

Visualizing LCOE data over the past decade (2009 – 2019) shows the high-cost element of renewables to be changing rapidly.[1] Solar and wind entered the decade at a significant cost disadvantage, of course. They began to reach competitive parity around the middle of the decade, and by 2019, solar and wind could generate power at competitive or lower costs in many circumstances.[2] [3] Multiple data sources show that the LCOE for solar (PV) fell by 82% from 2010 to 2019, with onshore wind falling by up to 39%.[4] [5]

Graph courtesy IRENA (International Renewable Energy Agency.)

Adding wind and solar to an electrical grid

However, LCOE is not sufficient to compare the merit of installing new generation capacity to power an electrical grid delivering safe, reliable, environmentally sustainable energy at all times. More accurately, LCOE is a measure of the marginal cost of adding more energy to an existing grid that already has the flexibility to balance various power sources. We can add wind and solar to some existing grids at low cost, where we have the capacity to replace their intermittent output with something else when they are not generating, and we can slow down other generators when wind and solar output are high.

Grid operators must deal with the costs of delivering electricity reliably and on demand. That requires baseload generation – power that is “always on”, such as hydro, nuclear, geothermal, gas, or coal. It also requires dispatchable peak capacity – facilities that can be turned on almost immediately to match demand. This is where we use “gas peaker” facilities – extra gas turbines that can come online with the flick of a switch, or variable output hydro facilities through which power output can be raised quickly by letting more water through the turbines when electrical demand surges.

Wind and solar deliver power intermittently, thus are not dispatchable and cannot be used as peaker facilities. Even if their power output is inexpensive, it is not always delivered when we need it – meaning electrical storage and other dispatchable generation capacity has to be in place to fill the gaps.

When we add more wind and solar power to a typical grid, we cannot take the old generation offline – because when it is cold and dark in the winter, wind and solar will not produce sufficiently, and we need the backup from existing gas/coal/hydro plants. So when comparing the cost of adding new generation capacity to the grid, the operator adding new gas turbines can decommission an old coal plant (as is happening in Alberta, Canada). If the operator adds new wind turbines, it must keep the old coal plant operating for backup to cover those times when the wind is not strong enough.

To address wind and solar intermittency, many electrical storage technologies are under development. More storage, especially long-term storage, means less need for backup, which translates to fewer peaker facilities and less need to keep the old generators running as backup.

But storage is an immature industry. Batteries are still very expensive and can deliver power for only a few hours at most. There are few storage solutions that are viable in the longer term, although several innovative technologies are being tested. Pumped hydro, which is quite effective for longer-term storage if there are many hydro sites, is prominent in places such as Switzerland and Norway.

The true cost of adding wind and solar to an existing electrical grid must include not only the LCOE from the wind and solar facilities themselves, but the cost of maintaining backup generation capacity, as well as adequate storage to maintain grid stability and reliability. Comprehensive costs will vary greatly from place to place, depending on the nature of the existing grid and the quality of the wind and solar resources that can be built. Moreover, to achieve LCOE estimates, wind and solar (and hydro) facilities must be built where the resource quality is best – the windiest and sunniest places – and tend to cost more to tie into the electrical grid. They also suffer greater transmission losses than new gas turbines that can be built close to demand centres.

The bottom line is that when comparing costs to add new generation capacity, planners must consider not only LCOE for typical facilities, but comprehensive costs to provide stable, dispatchable electricity under all circumstances – in any weather or any season.

What about the future?

Renewables (including wind, solar, hydro, biomass, and geothermal) accounted for 72% of all new electricity capacity additions globally in 2019,[6] and many project an acceleration moving forward.

What caused the price of solar and wind to drop so dramatically in the span of a decade, and will these trends continue?

Two primary factors have combined to drive cost reductions in wind and solar:

- Cost structures – learning curves and economies of scale

- Policy and subsidies

Cost structure of wind and solar

As discussed in the previous segment on environmental impact, wind and solar facilities differ from hydrocarbon generation in capturing dispersed but essentially free fuel sources (sun and wind). They are also relatively cheap to operate, meaning that the main cost driver is the capital cost of the wind turbines and solar panels. In contrast, coal, gas, and nuclear generation utilize concentrated fuel sources at focused sites, so the main cost drivers are fuel and operating costs.

The LCOE of solar has dropped dramatically because the efficiency of solar technology and the cost to manufacture it have followed a technological learning curve and have captured increasing economies of scale.[7] Some compare these gains to the emergence of cellular phone technology and personal computing. Coal- and gas-fired generation have not seen comparable cost reductions, as they are relatively mature technologies that have already achieved economies of scale and are dependent on fuel costs.

Increases in efficiency and affordability of wind and solar generation create a feedback loop, as falling prices mean that more generation projects are sanctioned. More projects support further investment in research and development and manufacturing of the technology, leading to lower prices.[8][9]

But we may be approaching hard limits to the downward cost trends on wind and solar. The laws of physics set limits to how efficient a solar panel or wind turbine can be – and the new technologies are rapidly approaching the theoretical maxima. Cost-effective efficiency gains always level out at some point, as they have for more mature generation technologies. Forecasts of efficiency and cost gains at rates similar to recent years extending far into the future do not address this reality. An analysis of offshore wind costs for the U.K. demonstrates that capital and operating costs are not falling over the past 18 years, even though cost reduction continues to be forecast.[10]

Policy and subsidies

While the price trends shown above were built using unsubsidized LCOE data, there is little doubt that policy and subsidies were essential components of the learning-curve trajectories followed by wind and solar technologies. It would certainly have taken substantially longer, and likely have been unfeasible, to achieve such economies of scale without the policy and/or subsidy encouragement provided with the aim of combatting climate change. [11] All of the world’s major markets have adopted some form of renewable energy subsidization, including long-term contracts, feed-in tariffs, or priority access to the grid. [12][13]

Policy and subsidy support for wind and solar has been justified as providing the means to offset the non-monetary costs humanity bears in environmental degradation, including GHG emissions, associated with fossil fuel combustion. While this is a valid point, we have not yet factored in the environmental degradation that will occur as wind and solar installations proliferate, greatly increasing mining activity and environmental issues associated with mining value chains.

Policy support aside, under certain circumstances, recent solar projects have moved ahead without the benefit of monetary subsidies.[14]

Other considerations

There are only so many optimal sites for wind and solar generation. Future facilities will be built in less desirable sites as the best ones are taken, or other factors such as proximity to demand centres are considered. The LCOE for wind and solar from less-desirable sites may be considerably greater than they are currently.

In many areas of the world, there may not be sufficient wind/solar/geothermal/hydro resources to meet electrical demand, particularly during seasonal extremes. This problem could become more extreme as society trends toward electrifying more segments of the economy such as transportation and space heating. A great illustration is in Alberta where coal-fired generation is being retired and is being replaced by efficient gas turbines. Even though wind and solar facilities are being built in Alberta with very competitive LCOE values, they cannot meet the province’s seasonal demands.

Finally, as more and more intermittent renewables are added to mature electrical grids – or are used to start up new grids and microgrids in lower-income countries – the challenges of balancing power generation and demand will only grow. When substantial long-term storage technologies are developed, they can address some of the challenges, but will add costs of their own.

Conclusions

The renewable technologies of wind and solar are no longer the unaffordable luxury goods they may once have seemed. Driven by policies and subsidies designed to reduce GHG emissions, they have seen continuous improvements in efficiency and cost, to the point where they can now economically compete in adding capacity to many mature electrical grids.

However, when considering the construction and maintenance of reliable electrical systems delivering power on demand at all times, only a certain amount of intermittent renewable energy can be added before operators must incur significant additional costs in backup generation, transmission infrastructure, and energy storage.

Evolving technologies and cost efficiencies, supported by government policy and subsidies, will continue to drive adoption of wind and solar power generation. But there are many limits and challenges looming as the 21st-century energy transition unfolds.

[1] Levelized cost trend data – Lazard’s Levelized Cost of Energy Analysis – Version 13.0 – November 2019 – Page 7

[2] IEA_WEO_2020 – Box 1.2 – PG35-36

[3] – IRENA – RENEWABLE POWER GENER ATION COSTS 2019 – P14, [visual 4]

[4] Levelized cost trend data – Lazard’s Levelized Cost of Energy Analysis – Version 13.0 – November 2019 – Page 2

[5] IRENA – RENEWABLE POWER GENER ATION COSTS 2019 – P12

https://www.irena.org/publications/2020/Jun/Renewable-Power-Costs-in-2019

[6] IRENA – RENEWABLE POWER GENER ATION COSTS 2019 – P12

https://www.irena.org/publications/2020/Jun/Renewable-Power-Costs-in-2019

[7] – https://ourworldindata.org/cheap-renewables-growth – subsection on Moore’s law and learning-curves

[8] RethinkX Rethink Energy – Pg 15

[9] https://ourworldindata.org/cheap-renewables-growth – Section – Do electricity prices follow learning curves

[10] https://briefingsforbritain.co.uk/the-costs-offshore-wind-power-blindness-and-insight/

[11] IEA_WEO_2020 – WEO – chapter 6.1 – P215

[12] IEA_WEO_2020 – WEO – chapter 6.3.6 – P234-235

[13] https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Apr/IRENA_Energy_subsidies_2020.pdf – Page 8

[14] IEA_WEO_2020 – WEO – chapter 6.3.6 – P237

(Jessie Keith – BIG Media Ltd., 2021)