Nearly every day, we see media stories about the limited lifespan of the oil and gas industry, primarily, it seems, from people in high-income countries focused on reducing anthropogenic greenhouse gas emissions.

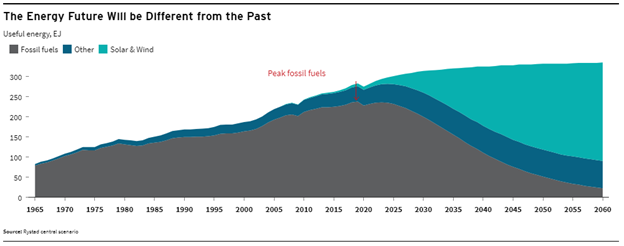

Organizations such as Carbon Tracker suggest that “companies have not sufficiently factored in the possibility that future demand could be significantly reduced by technological advances and changing policy.” As a result, they project that oil industry investors will be left holding “stranded assets” – that is, oil and gas production that is no longer in demand. Rocky Mountain Institute, with a mission to “transform the global energy system to secure a clean, prosperous, zero-carbon future for all” forecasts “peak fossil fuels” in 2020, followed by a massive production decline in the late 2020s, to be replaced almost completely by a massive expansion of solar and wind energy (Figure 1).

Figure 1 – chart from Rocky Mountain Institute showing its forecast for “peak fossil fuels”.

Many others insist that oil demand will fall precipitously in the very near future, on the logic that humanity must achieve a variety of greenhouse gas emissions reduction goals aimed at reducing the pace of climate change. One of the most prominent proponents of this view is Antonio Guterres, Secretary General of the United Nations, who calls the oil and gas industry “planet wreckers”, and is quoted as saying “we are hurtling toward disaster, eyes wide open, with far too many willing to bet it all on wishful thinking, unproven technologies, and silver-bullet solutions,” apparently referencing emissions-reduction technologies such as carbon capture and storage (UN chief attacks oil and gas industry ‘planet wreckers’ over fossil fuel expansion).

Within a few days of these statements, the International Energy Agency (IEA) released its annual medium-term outlook for oil, Oil 2023. It is advertised as a “comprehensive overview of evolving oil supply and demand dynamics through to 2028.” I found it to be an intensive, data-driven analysis that not only forecasts global oil supply and demand through 2028, but provides breakdowns by regions and sectors. One can always question and adjust the many assumptions that go into such a project, but overall it is a good piece of work.

Oil 2023 presents some clear conclusions.

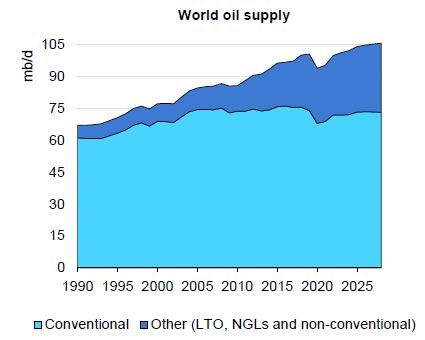

- Annual world oil production has increased year-on-year for more than 30 years, interrupted only by the COVID-19 downturn (Figure 2)

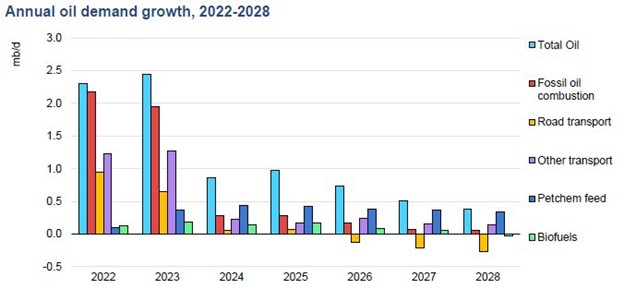

- Annual world oil production is forecast to increase further every year through the end of the forecast period (2028). The rate of increase is expected to decline based almost entirely on the assumption that oil products will be displaced by alternative transportation fuels within the next five years (Figure 3)

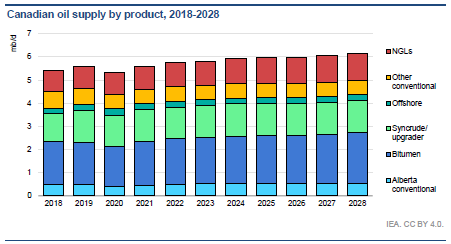

- Oil supply from various jurisdictions will vary significantly depending upon geopolitical developments, but Canada’s oil production will continue to rise gradually (Figure 4)

Figure 2 – a look at steadily increasing oil production – with the exception of pandemic-affected 2020 – from the IEA’s “Oil 2023” report.

Figure 3 – oil demand projections through 2028 from the IEA’s “Oil 2023” outlook.

Figure 4 – the IEA’s forecast for Canadian oil production by product.

These all make pretty good sense. There are more than eight billion people in the world today, each and every one of them demanding the fuels, petrochemical products, and other goods and services produced and delivered by oil. While those of us fortunate enough to live in high-income nations have most of these demands fulfilled, billions of people in lower-income nations need energy to live a modern life. It is hard to see how oil consumption could do anything but rise.

Not surprisingly, many attempt to spin the report to convey different messages.

“Electric cars will reverse demand for transportation fuels by 2027,” says Bloomberg (Peak Oil Demand Is Coming Soon for Transportation).

“Why Canada Needs to Plan for a Steep Decline in Global Oil Demand,” declares the International Institute for Sustainable Development.

Even the IEA press release accompanying Oil 2023 states, “Growth in the world’s demand for oil is set to slow almost to a halt in the coming years, with the high prices and security of supply concerns highlighted by the global energy crisis hastening the shift towards cleaner energy technologies” (Growth in global oil demand is set to slow significantly by 2028).

Let’s look at what the data and forecasts really say. Looking back at Figure 2 – in 2028, humanity is projected to consume 105 million barrels of oil every single day, about five million barrels more every day than at present. That assumes that rapid growth of electric vehicles continues to accelerate to displace oil demand.

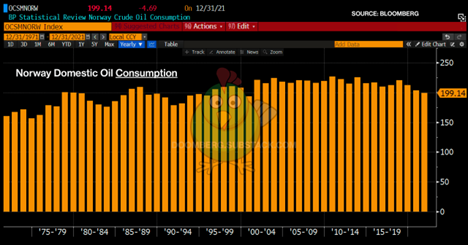

But would that even happen? Look at the daily oil consumption for Norway – in the land where EV penetration is highest, oil consumption has hardly fallen in recent years (Figure 5). As of March 2023, Norwegians are burning more oil over the previous year – 217,000 barrels per day. (Norway – Total petroleum consumption).

Figure 5 – oil consumption in Norway.

And we know that the supply chains for critical components of batteries and EVs are inadequate, and that raw materials costs are rising dramatically (Critical minerals to play major role in emerging technologies). Without solving these issues, EV growth cannot continue unabated, and oil demand stands to rise even more rapidly.

But let’s ignore this issue, and assume that oil consumption peaks in the late 2020s. What happens after that? A demand plateau and at some point gradual decline, as more ways are found to decrease oil demand in high-income nations and slow the rate of demand growth in lower-income nations. That said, RMI’s abrupt and massive demand decrease (Figure 1) will not happen, short of decimation of the human race, because alternative energy sources cannot be developed that quickly (Real-world lessons on energy transition).

The problem the world faces today is not too much oil, but too little. Investors have been driven away from oil and gas, protests have slowed or halted oil and gas infrastructure projects, and students entering university are being discouraged from studying petroleum geology and engineering. A huge generational skills gap is widening, and we face the prospect of not having the people we need to maintain oil supply over the next decades. Canada’s oil resources are immense, but production is forecast to rise only gradually largely because of social and regulatory obstacles.

As rich western nations deal with these internal conflicts around oil production, countries with far less stringent environmental standards and substandard human-rights records are more than willing to fill the gap. So we face not only oil shortages and higher energy prices, but increased geopolitical conflict and economic damages such as those occurring in Europe today as governments struggle desperately to replace Russian oil and gas.

Finally, let’s remember that energy security trumps all other human considerations. It’s easy to say that climate change is your top priority when you have abundant energy at your fingertips – but one’s priorities are quickly re-arranged when energy is not there, as I discussed a few months ago (What the world needs now is energy education and pragmatic energy policy).

Policymakers in all nations must understand energy security, and realize that it will depend heavily on affordable, available, and adequate oil supplies in the coming decades. Discouraging oil development will precipitate – actually, is already precipitating – energy poverty and human misery. It is time to undertake energy planning based on energy, not on emissions.

Figure 1. Rocky Mountain Institute’s forecast for global useful energy production through 2060. Note the rapid and massive decline in fossil fuel production predicted right after 2025, replaced almost entirely by an equally rapid and dramatic increase in solar and wind energy production, Peaking: The Series

Figure 2. World oil supply from 1990 to 2028, Oil 2023, International Energy Association

Figure 3. Forecast growth in world oil demand from 2022 to 2028. Note that the slowing rate of demand growth is based largely on the assumption that alternative fuels will displace a significant quantity of oil products for transportation., Oil 2023, International Energy Association

Figure 4. Canadian oil supply from 2018 to 2028. Growth is driven largely by increased bitumen production and natural gas liquids associated with LNG production. https://www.iea.org/reports/oil-2023, Oil 2023, International Energy Association

Figure 5. Daily Norwegian domestic oil consumption (in thousands of barrels of oil per day), Doomberg, Stuck in the Middle With You

(Brad Hayes – BIG Media Ltd., 2023)